Summer is here, and that means three things: barbeques, beach vacations, and seemingly constant humidity.

Humidity is everywhere, but location and environment play a role. For example, relative humidity in Florida, Texas, and Mississippi is higher than in Arizona, New Mexico, and Nevada. This is because the former states are located near large bodies of water, as opposed to arid deserts.

Unfortunately, humidity is becoming a problem in the United States. According to a 2025 scientific study, humid heat waves have become stronger. As temperatures rise across the board, they lead to more water evaporation. As water evaporates, it increases humidity, which is bad for people, animals, and solar panels alike.

Luckily, solar developers have several tools to prevent humidity and moisture from damaging their installations. Knowing how humidity works is the first step toward protecting sites from damage and lost output.

What is Humidity?

Humidity is an environmental condition measured by the amount of water vapor in the air at any given time. This moisture typically comes from water evaporating from bodies of water, but can also come from plants, soil, and rain.

There are two types of humidity (absolute and relative), but relative is the one most people are familiar with. Relative humidity determines the percentage of water vapor in the air compared to its potential maximum. As temperatures rise, relative humidity decreases. As temperatures fall, the air holds less water vapor, creating dew and fog.

Easy access to water sources results in higher humidity levels for those living in those regions. This is why Florida and Louisiana have higher levels than drier states like Arizona and New Mexico. High heat keeps relative humidity low since the air can hold more water vapor.

Though humidity is a constant presence, it becomes more of a threat during the summer when temperatures rise. Hot air holds more moisture than cold air, which is why you don’t hear about humidity during the winter – the air is drier.

How Does Humidity Impact Solar Sites?

It might not sound like it, but as the air outside gets moister, the resulting humidity can slowly cripple a solar farm.

And like many weather-based issues, it impacts every component from the ground up.

Solar Panels

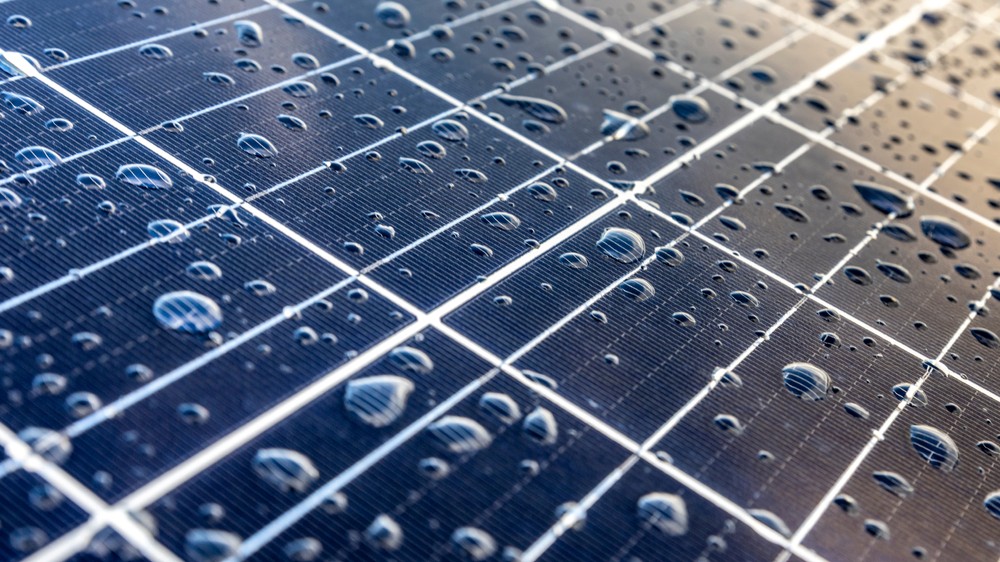

When humidity is a concern, so is condensation. As temperatures retreat from their daytime highs, water vapor in the air forms droplets. Those droplets fall onto solar panels, mixing with dust and other gunk already there.

As the water evaporates again, the dust left behind sticks to the panels and becomes hard to remove. If enough dust becomes stuck, panels may struggle to collect sunlight, reducing performance. The attached dust is also dried on, meaning crews must do more intense cleaning.

Beyond simply making panels dirty, moisture can also become trapped inside panels. If that happens, water can create a film that could increase panel operating temperatures and hurt power generation.

Reduced Performance

Reduced performance comes in many forms, including Potential-Induced Degradation (PID).

PID occurs when there’s a combination of hot temperatures and high humidity. When long strings of panels are tied together, those on the ends of the row carry the largest electrical pressure difference. These voltage differences between the solar cells and their frames may create small leakage currents.

So, how exactly does humidity impact performance? When small leaks occur, rain and humidity increase system conductivity, leading to greater losses. It can also add stress to panels, as humidity fluctuations can leave water droplets on the panels’ faces.

But sometimes performance issues stem from something simpler. Excess moisture can cause a wide range of problems when it gets inside a panel. For example, errant water can cause delamination inside the panel, along with mold growth in or on its face. In both cases, the panel can’t efficiently collect sunlight, limiting output.

Wire and Connectors

If moisture gets into a faulty, damaged, or improperly installed connector, it can immediately affect the system.

Wet connectors are a breeding ground for short circuits and faults, which can drastically reduce output. However, water can also enter through cracks in damaged wire insulation.

When moisture penetrates a PV wire’s insulation, it can damage the wiring. If installation or maintenance crews don’t spot the damage, it could lead to arcs, shorts, and faults. Worse yet, it could spark a fire, damaging nearby panels and racking.

Racking

Racking may not be exciting, but it’s critical to a solar project’s overall power generation.

High humidity introduces moisture to the equation, which can ravage unprotected metal racking systems. Solar developers should either invest in corrosion-resistant materials or use coatings to make the racks resistant to corrosion.

Without proper protection, the systems are more likely to rust and show wear while leaving the door open for mold growth. If mold or rust forms around tracking system components, it could prevent panels from moving with the sun.

Preventing Damage from Humidity

While it’s impossible to stop humidity from occurring, it’s possible to protect solar sites from damage. All it takes is a little preparation and patience.

- Invest in hydrophobic coatings. These specialized coatings repel water, preventing it from accumulating or entering sensitive areas.

- Keep up with cleaning. Regular maintenance cleaning removes dried bits of dust and other crud from solar panels. It also gives moisture fewer opportunities to create mud on the panels, reducing performance.

- Don’t skimp on seals. Seals prevent outside debris and moisture from entering solar panels and causing damage to sensitive components.

- Invest in high-quality PV wire products. Work closely with manufacturers that install connectors in-house and perform quality control testing. Unlike field-made connectors, which could be mistake-prone, employees test every connector to ensure a tight seal. This prevents moisture from entering through openings and shorting wires.

- Use the right wire for the job. Utility-scale solar projects are massive endeavors and long-term installations, so buy high-quality wire when possible. Invest in UL 4703-certified PV wire, as other types may offer less protection. PV wire can withstand harsh outdoor environments and is moisture, weather, abrasion, and UV resistant.

- Explore your conductor options. Copper is the most common PV wire conductor, offering good conductivity across many applications. Aluminum is lighter than copper and more affordable but needs larger gauges to match copper’s conductivity and may oxidize over time. Tinned copper offers better corrosion protection than copper alone, but developers will pay extra for additional peace of mind.

Risk, Rewards, and Resilience

Humidity is a necessary and important component of our natural environment. However, solar technology is rapidly improving to make solar projects more resilient against its effects.

As products and methods improve, solar sites enjoy increased clean energy production, higher levels of safety, and longer project lifespans. Meanwhile, consumers benefit from low-cost renewable energy, utilities and operators produce more power, and sites generate higher ROIs.

Solar sites require an incredible amount of planning, and no one knows everything. When questions pop up, know who to reach out to for advice and guidance. Oftentimes, this means reaching out to a trusted manufacturer or distribution partner. Their insight can simplify the installation process and make it easier to maintain products over their usable lifespan.

This ultimately leads to better, more efficient projects that benefit everyone.