When you ask the average person about solar, their answer generally extends to what they see – endless rows of solar panels, racking systems, and thick bunches of PV wire.

But beyond the main parts and pieces, vital accessory systems keep utility-scale solar operations running smoothly. From tracking weather and fighting fires to system monitoring and electrical grounding, these systems are the eyes and ears of every site.

Though every solar project is unique, most large-scale sites share several monitoring systems. When they combine, the data they collect gives operators unparalleled insights into every aspect of their site.

Remote Monitoring Systems

Like the home security system protecting your house, cloud-based remote monitoring systems (RMSs) protect solar sites from potential damage.

These systems monitor performance metrics and track voltage, output, and system status. Sensors collect data in real time and then send it via an internet connection to the cloud. Operators can access the data anytime to get vital information, see status changes, and make system changes remotely.

Remote monitoring systems make operators more proactive, keeping power flowing with less boots-on-the-ground troubleshooting.

Eyes in the Sky

When used correctly, RMS identifies system failures before they cause damage or lost production.

Sensors collect data 24/7, using the information to create baselines and trends. If something occurs at the solar site – for example, damaged panels or inverters, the system pings the operator. From there, the utility or owner can take action.

But not every issue is a full-blown disaster. Remote monitoring’s ability to spot trends makes it easier to find improvement opportunities. If performance drops at certain times, for example, operators can send a crew out to look for shaded panels. A consistent performance decrease over time could signal soiled panels, meaning a cleaning might be due.

Having access to detailed reports is a game-changer for operators. Remote monitoring works alongside other systems, including weather stations, to produce comprehensive reports using historical data. With it, operators can constantly make tweaks to improve performance.

Remote Monitoring Limitations

Unfortunately, remote monitoring systems aren’t perfect.

Rural solar installations may not have reliable internet access, making it harder to send data to the cloud. With that said, operators have several options, including 4G/5G wireless connections, satellite internet, or point-to-point wireless networks.

Additionally, like any internet-connected device, there’s always the risk of a cyberattack. If that happens, bad actors could access sensitive data and systems. For operators, cyberattacks may result in power disruptions and shutdowns or data loss and theft.

Finally, monitoring systems can be expensive. Operators may need outside experts to set the system up correctly and ensure it’s collecting accurate data. With that said, hiring the right team is critical to getting everything you need out of the RMS.

Weather (Meteorological) Stations

Like remote monitoring systems, weather stations collect vast amounts of data. The difference is that the data they collect is environmental, not performance.

Weather monitoring stations collect everything from solar radiation and temperature measurements to rain and snowfall totals, wind speed, and humidity data. Once combined, the data paints a picture of the overall conditions to help operators understand performance data.

Together, RMS and weather data can answer questions tied to overall performance. For example, the two systems can explain what happens during weather events, giving operators the tools to develop maintenance, cleaning, or repair plans.

Neither Snow, Nor Rain, Nor Heat…

Although weather is unpredictable, it can be used to spot seasonal trends over time.

As the WMS collects data, operators see more clearly what to expect during different parts of the year. It might not seem like much, but in areas with four distinct seasons, weather trend data is invaluable. With it, crews can plan for cleanings, maintenance, and other work when openings allow.

For the average operator, accurate data does more than make scheduling easier. Over time, forecasting accuracy increases, backed by years of tracking data. Based on expected weather trends, operators can change panels’ tilt and facing to meet conditions and increase production.

Trend data also helps operators determine the amount of risk weather events may cause to the system. Historical data can determine what past events did to the system, giving workers valuable clues about what to expect.

More information leads to better risk management and fewer setbacks.

Weather Monitoring Limitations

Although WMS data is comprehensive, it’s also highly technical.

Operators need specialists to set up and calibrate each monitoring station. Unfortunately, large solar farms can cover many acres, and conditions change from one spot to another. Depending on the size of the site, operators could need multiple stations to get full coverage and accurate data.

Despite the cost, meteorological stations drastically improve the quality and quantity of data collected, especially when combined with remote monitoring systems.

Fire Suppression Systems

A fire is one of the worst things that can occur at a solar site.

PV systems produce a lot of electricity, and fires can start if there is an arc, fault, or wire damage. Unfortunately, many utility-scale systems sit in remote areas, making it hard for crews and firefighters to respond quickly.

When fires occur, expensive repairs are needed, potentially costing millions of dollars to get back up and running.

Solar Farm Fire Risk Factors

You’d be surprised how little it takes for a fire to erupt at a solar power site.

Common causes include:

Electrical issues: Small nicks in the wiring can create arcs and faults, leading to fires. Other components also pose fire threats, including overheating panels, inverter issues, and even short-circuiting battery storage.

Lightning: Solar sites occupy a lot of land, making them targets for lightning strikes. When lightning hits the installation directly, it can damage panels, wiring, inverters, and other components. Indirect strikes are just as bad, leading to power surges and ground currents that could increase fire risk.

Objects and plants: This is a two-fold problem. Plants and objects touching panels or electrical components risk getting shocked, electrocuted, or starting a fire.

Meanwhile, plants or trees that cover parts of the solar panel with shade create hot spots. Over time, hot spots can lead to overheating and reduced power generation.

Accidental damage: We all make mistakes, but sometimes mistakes lead to massive problems down the line. Nicks in the PV wire, damage to the panels, or even a faulty connector can start a fire.

Fighting Fires from Afar

Site operators have several options for remote fire suppression, ranging from water and misting to foams and carbon dioxide.

Fire suppression systems monitor the site for issues and act to extinguish fires before they can spread. If a fire breaks out, these systems are the first line of defense, protecting valuable components until responders arrive.

Of course, as good as a fire suppression system is, it doesn’t replace vigilance and planning. Operators need a fire prevention and protection plan to keep crews, local responders, utilities, and others informed.

Grounding Systems

When power surges or faults occur at a solar site, they threaten the entire system.

Utilities rely on grounding systems to create a low-impendence route for electricity and prevent temporary overvoltage (TOV). When TOVs happen, the voltage rises above its usual levels for a sustained period. Unlike lightning strikes, which may spike voltages for a short time, TOVs could highlight fault conditions or other problems.

Grounding systems are critical to any solar installation. Without them, solar sites could see component failures, fires, and total system failures. Grounding reduces the potential difference between the earth and energized surfaces is almost zero.

Keeping Up with Codes

From a safety standpoint, installing a grounding system makes sense. But if that isn’t enough evidence, effective grounding is required by many code departments.

For prospective solar operators, that means working closely with local code departments to follow NEC standards. They might seem like additional hoops to jump through, but they ensure every project is as safe as possible.

In other cases, many insurers require proper grounding for all systems before issuing an insurance policy.

Systems for a Better Solar Energy Industry

Solar sites across the United States rely on an intricate web of monitors to protect and optimize their sites.

Let’s face it – clean energy projects are huge investments. If there’s a way for operators to protect them with cost-effective solutions, they will.

Combining performance data, weather information and trends, and fire detection monitoring helps operators maximize their investments. As more features tie into the ever-growing Internet of Things (IoT), operators will continue making better decisions faster. Additionally, their teams are more effective because they aren’t relying on hunches and incomplete data.

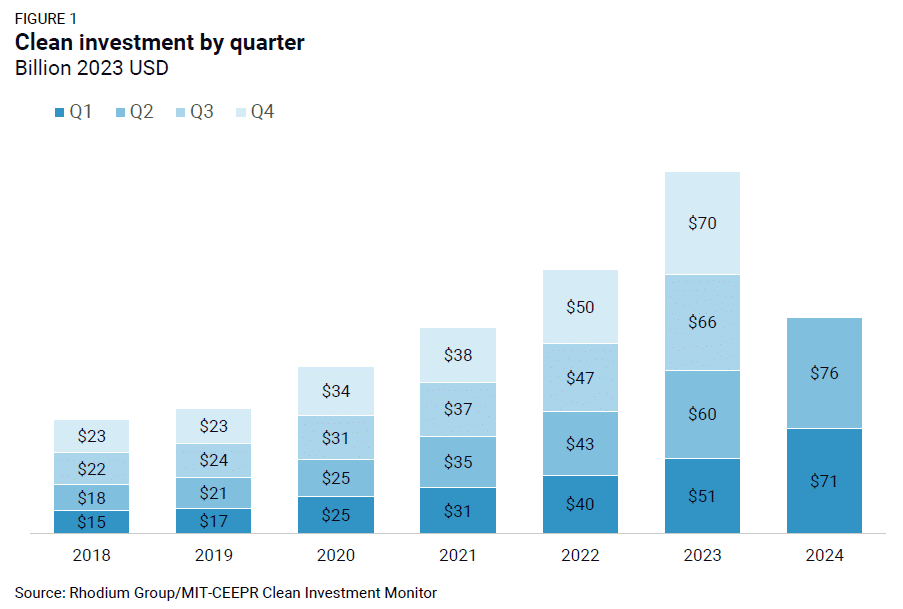

Solar energy is taking off in the United States – it’s only fair to assume site technology will grow alongside it. Most importantly, better technology leads to improved power output, more reliable systems, and happier end users.